Retailers Prepare New Supply Chain Strategies Ahead of Potential Tariffs

US retailers and manufacturers are preparing for President-elect Donald Trump’s second presidential administration, where the incoming president will likely fulfill one of his campaign promises: proposed universal tariffs. Tariffs are effectively a tax on imported goods paid by the importing entity to the US government.

Here are some key elements of the proposed tariffs so far:

- China: President-elect Trump described a blanket 60% tariff on Chinese goods while campaigning, and tariffs could range anywhere from 60% to 100% starting in Q1 2025. A November Reuters economist poll estimated tariffs nearer 40%. In November, Trump posted on Truth Social that he planned to add an additional 10% tariff over previous ones. The proposed Chinese tariffs are higher than the 7.5%-25% levied during Trump’s first term.

- Mexico and Canada: Trump also proposed tariffs on Mexico between 25% and 100% depending on future border policies. In November, Trump pledged on Truth Social to enact 25% tariffs on imports from Canada and Mexico.

- Other Countries: Trump described a 10-20% tariff on all imports while campaigning. In December, he threatened a 100% tariff against BRICS nations (Brazil, Russia, India, China, Iran, the United Arab Emirates, Ethiopia, Egypt, and South Africa) over the creation of new currencies.

While there have been additional statements and speculation around 2025 tariffs, it is uncertain what tariff levels will look like and to which countries they will be applied.

What Industries Will Be Affected by Proposed Tariffs?

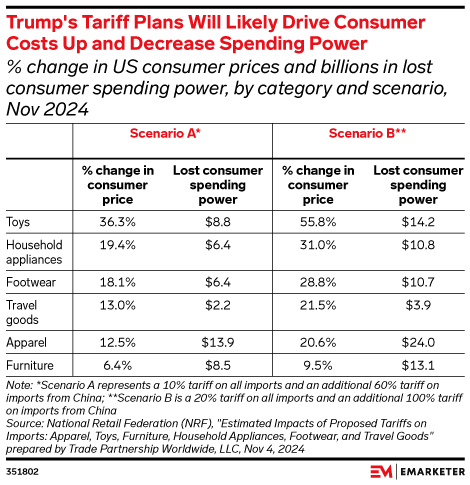

A variety of industries will be affected by the proposed tariffs. Unless otherwise cited, the following data reflects scenarios described by EMARKETER based on National Retail Federation (NRF) data or data provided by the NRF in a recent report.

- Apparel: While the US has decreased its imports of apparel and accessories from China, Chinese-made goods still accounted for 21% of US apparel imports as of 2023, per the US International Trade Commission’s 2024 report Apparel: Export Competitiveness of Certain Foreign Suppliers to the United States. The proposed universal tariffs may also affect apparel imports from other countries, with a decrease in imports from all sources projected between 21.9% and 33%. Increases in apparel prices could range between 12.5% and 20.6%.

- Footwear: Per the Footwear Distributors and Retailers of America (FDRA), 90% of the industry’s volumes come from China, Vietnam, and Indonesia. Proposed tariffs apply to both fully manufactured footwear and footwear parts used by US manufacturers to finish products in the United States. Increases in footwear prices could range between 18.1% to 28.8%. Imports could decrease between 28.7% and 40.1% across all sources.

- Furniture: The US currently leverages an average 5.4% tariff on furniture. Proposed tariffs could decrease imports from China up to 87%, with a decrease from all sources between 28% and 39.7%. Furniture prices could increase between 6.4% and 9.5%.

- Household appliances: Under proposed tariffs, appliance prices could increase between 19.4% and 31%. Imports from China could decrease between 77.5% and 89.8%, with a potential decrease from all sources between 29.6% and 41.7%.

- Toys: Current US tariffs on toys average to 0.1%. Increases in toy prices could range between 36.3% to 55.8%, one of the highest potential increases according to the NRF. Decreases in toy imports across all sources could range from 52% to 64.9%, and imports from China could decrease by up to 85.6%.

- Travel goods: This category includes items like backpacks, bags, wallets, luggage, and more. As of 2023, the tariff on these goods averaged 17.5%. Prices could increase between 13% and 21.5%, and imports from China could decrease between 74% and 87.3%. Total imports from all sources could decrease by up to 34.8%.

EMARKETER describes two scenarios for impacted industries from a recent National Retail Federation (NRF) report.

Tariffs will potentially affect other consumer categories as well. For example, grocery prices may increase. The total value of food imported into the US in 2023 neared $190 billion, and the US is reliant on produce grown abroad. Tariffs also place pressure on grocery prices by increasing the cost of imported manufacturing equipment, agricultural chemicals, and packaging materials.

What Tariffs Mean for Supply Chains

Supply chain leaders will experience a variety of short and long-term tariff effects—and must plan accordingly.

Freight Rate Increases

Over the next 3-6 months, expect both international and domestic freight rates to spike as import volumes increase as companies forward stock inventories, like what occurred after the Trump administration increased tariffs on Chinese imports in its first term. Spikes in import volume may ultimately be short-lived, however. Higher tariffs discourage imports and slow shipping volumes over time. Once tariffs are implemented, importing goods to the US will increase costs.

Increased Warehousing and Shipping Costs

Many companies hope to reduce tariff exposure in the short-term by creating inventory stockpiles. If stockpiled inventory volumes increase significantly, that may subsequently increase warehousing and shipping costs. Some supply chain leaders may seek to optimize and expand warehouse footprints and carrier partnerships to support larger inventories.

Continued Supply Chain Diversification

Many organizations focused on supply chain diversification over the past decade, shifting or adding sourcing and manufacturing to their portfolios to mitigate risks and improve supply chain flexibility. With looming tariff changes, supply chain leaders will continue to restructure and evolve their supply chains to optimally source materials and manufacture goods. For example, some manufacturers already shifted from China to Mexico under the Trump-negotiated USMCA trade deal. Apparel, sportswear, and footwear manufacturers currently leverage a diverse production portfolio from Vietnam to Bangladesh and beyond.

Moving forward, supply chain leaders will seek to diversify their partner portfolio across the globe, with many relying on partnerships that already exist in East Asia and the Americas. Some companies may pursue US-based manufacturing, trading off higher costs if their products require both the intellectual capital and high automation available in the US.

Supply Chain Strategies for Potential Tariffs

There are a variety of short and long-term supply chain strategies designed to mitigate tariff risks. They include forward stocking inventories, raising prices for consumers or accepting lower margins, and diversifying product sourcing and manufacturing.

Accelerate Forward Stocking Inventories

In the short-term, many US businesses are returning to strategies leveraged during Trump’s first term. Brands like Stanley Black & Decker plan to forward stock inventories with imported goods before tariffs are enacted. Chinese exports surged in October, rising nearly 13% year-over-year, and this surge may have been driven partially by frontloading activities ahead of the US election. Organizations will likely expand inventories further in December.

Forward stocking inventories can create bandwidth for retailers to plan long-term tariff strategies. Organizations can import key products and materials early to avoid cost increases, then explore additional methods to curb tariff impacts, like price changes and sourcing diversification.

Increasing inventories ahead of Q1 2025 has its risks:

- Some industries, like apparel and footwear, may import items that could age out of season, key trends, or fashions next year.

- Accelerating production may not be an option for all organizations across impacted industries.

- Many supply chain leaders must balance import timing between potential US port strikes and the Lunar New Year starting on January 29.

- Some organizations recall lessons learned after the COVID-19 pandemic, when many struggled to reduce inflated inventories and high supply chain costs amid sluggish sales.

Some examples of brands forward stocking inventories include:

- Bare Botanics: The skincare company indicates that it will stockpile key inventory.

- Stanley Black & Decker: The tool company plans to forward stock relevant inventories ahead of 2025 tariffs.

- Stone Fleury: The stone and porcelain company seeks to purchase as much inventory as possible ahead of tariffs.

- Williams-Sonoma: The home products retailer referenced frontloading certain products in 2025 to mitigate tariff impacts.

Adjust Prices for Consumers or Face Lower Margins

Many retailers will be forced to assess their pricing strategies to absorb increased tariff costs. Many will choose to pass costs on to the end consumer or deal with lower margins.

Some examples of brands already considering price changes:

- AutoZone: AutoZone’s CEO told analysts that the auto-parts retailer will pass tariff costs on to consumers.

- Traeger: The grill brand currently manufactures 80% of its grills in China, with 20% made in Vietnam. They will consider price increases as a lever to deal with impending tariffs, as well as shifting manufacturing to other East Asian countries.

- Stanley Black & Decker: Donald Allan, CEO of the tool making company, discussed on an earnings call that the company will likely raise prices to mitigate tariffs.

- Under Armour: The sportswear brand noted that tariffs could impact the cost of goods and gross margin starting in 2025.

- Yeti: The cooler and drinkware brand is considering price changes to offset additional tariffs.

Diversify Product Sourcing and Manufacturing

Many logistics leaders will continue to diversify their supply chains to minimize tariff impacts. Per a Bain survey, 81% of companies plan to bring supply chains closer to home markets over the next three years. The process will be challenging, however. Only 2% of respondents have completed onshoring or nearshoring plans. Twenty-three percent are evaluating options and 36% are currently in the planning stage.

Previous tariffs caused many retailers to begin diversifying sourcing away from China. For example, many sportwear and footwear brands shifted to Vietnam due to 2018 tariffs. While tariffs can spur domestic manufacturing, companies may find relocating manufacturing to the US difficult, given the high cost of wages and shortage of skilled workers relative to other countries.

Some examples of brands that plan to diversify sourcing and manufacturing due to tariffs:

- Adidas: The footwear company aims to halt the procurement of US goods from China and plans to localize production in certain geographies to increase supply chain agility.

- e.l.f. Beauty: The cosmetics brand began diversifying sourcing amid 2018 tariff hikes, reducing its China-sourced products by 19%. Growing sales beyond the US may also soften the impact of US-based tariffs.

- Home Depot: The home improvement company analyzed inventories to determine tariff impacts at the SKU-level during President-elect Trump’s first term. The company intends to leverage a similar strategy in 2025.

- Ralph Lauren: The fashion brand has diversified its sourcing over the past seven years and continues to develop and scale supply chain capabilities to mitigate tariff risks.

- Stanley Black & Decker: The tool company began planning tariff mitigation strategies in early 2024 and plan to shift production from China to other Asian countries or Mexico in the next two years.

- Steve Madden: The apparel brand is reducing its reliance on China for sourcing materials and products by 40-45% over the next year.

- Yeti: The cooler and drinkware brand plans to push its manufacturing footprint beyond China and plans to launch a second production site outside the country by Q3 2025.

Work with Logistics Partners to Prepare for the Future

The supply chain landscape will shift under new US tariffs, and trusted logistics partners can help retailers navigate as they implement updated strategies in 2025 and beyond. In addition to determining short and long-term tariff strategies, supply chain leaders can connect with new or existing logistics partners to assess freight brokerage, transportation, and warehousing/storage needs. These partners leverage their expertise and core competencies to expand logistics options and build further flexibility for retailers amid tariff changes.

The Radial Difference: Prepare for Tariff Changes with a Trusted 3PL Partner

Retailers don’t have to navigate tariff changes alone. Supply chain leaders can work with a trusted 3PL partner like Radial to manage uncertainty, mitigate risks, and create the bandwidth necessary to build long-term tariff strategies.

Radial offers an on-demand solution designed to give retailers the warehouse capacity needed to forward stock surplus inventories ahead of tariff changes. Retailers leverage Radial’s strategically located facilities across the US to access inventory quickly. Our solution includes on-demand storage options, fast onboarding, critical inventory visibility, and flexible pricing. All with a logistics partner leveraging 30+ years of experience and a leadership team dedicated to helping clients navigate new logistics challenges.

For current Radial clients, we can work with your supply chain leaders to securely store additional inventories in current facilities. That means seamless access through the trusted partnership we already share.

While forward stocking key inventory is a short-term strategy leading into 2025, it can benefit retailers by providing a buffer at current costs to manage margins. Retailers buy time to determine ideal long-term strategies.

- Adjusting Prices: Stockpiled inventory can allow retailers to slowly introduce price changes rather than shocking consumers with sudden increases. It can also create a competitive advantage if the other retailers are forced to suddenly raise prices to account for tariff impacts.

- Diversifying Product Sourcing and Manufacturing: Forward stock buys retailers time to select new sourcing and manufacturing options, creating a strategic opportunity rather than a time-sensitive one. This ensures brands and products are protected.

About the Author

Matt Barr | VP, Marketing

Matt Barr guides Radial’s marketing strategies and product innovations to align with our organizational vision. A seasoned professional, Matt has over 15+ years of deep immersion in the logistics sector. Throughout his career, he has donned various hats, giving him a comprehensive understanding of the industry and the brands we serve.

Learn how Radial can help you with eCommerce fulfillment.