Potential New US Tariffs Could Mean Inventory Stockpiles for Many Retailers

US retailers and manufacturers are preparing for President-elect Donald Trump’s second presidential administration, where the incoming president will likely fulfill one of his campaign promises: proposed universal tariffs. Tariffs are effectively a tax on imported goods paid by the importing entity to the US government.

Many retailers will consider stockpiling inventories strategically in the short-term to avoid tariff costs while assessing long-term tariff strategies for their supply chains.

What We Know About Potential Tariffs

Here’s what we know about potential tariffs so far:

- China: President-elect Trump described a blanket 60% tariff on Chinese goods while campaigning, and tariffs could range anywhere from 60% to 100% starting in Q1 2025. A November Reuters economist poll estimated tariffs nearer 40%. In November, Trump posted on Truth Social that he planned to add an additional 10% tariff over previous ones. The proposed Chinese tariffs are higher than the 7.5%-25% levied during Trump’s first term.

- Mexico and Canada: Trump also proposed tariffs on Mexico between 25% and 100% depending on future border policies. In November, Trump pledged on Truth Social to enact 25% tariffs on imports from Canada and Mexico.

- Other Countries: Trump described a 10-20% tariff on all imports while campaigning. In December, he threatened a 100% tariff against BRICS nations (Brazil, Russia, India, China, Iran, the United Arab Emirates, Ethiopia, Egypt, and South Africa) over the creation of new currencies.

While there have been additional statements and speculation around 2025 tariffs, it is uncertain what tariff levels will look like and to which countries they will be applied.

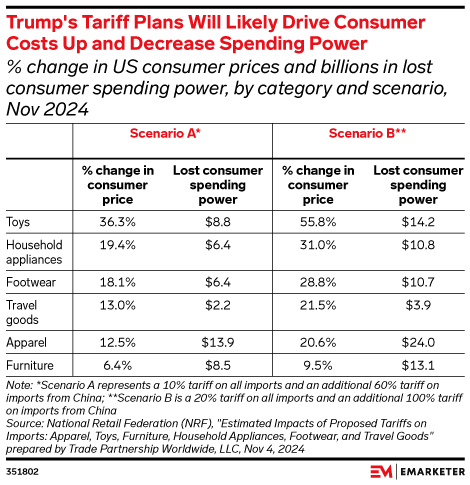

Per EMARKETER, industries that will be most impacted by increased tariffs include:

- Toys

- Household appliances

- Footwear

- Travel goods

- Apparel

- Furniture

EMARKETER describes two scenarios for impacted industries from a recent National Retail Federation (NRF) report.

Tariffs will potentially affect other consumer categories as well—from grocery prices to luxury goods.

What Tariffs Mean for Supply Chains and Consumers in the Short-Term

Many retailers are preparing for future tariffs by stockpiling inventories. They plan to order higher volumes of imported goods as a short-term solution to avoid future tariff costs. Supply chain leaders are already considering longer term strategies, including diversifying supply chains and shifting manufacturing beyond China.

Over the next 3-6 months, expect both international and domestic freight rates to spike as import volumes increase, like what occurred after the Trump administration increased tariffs on Chinese imports in its first term. Spikes in import volume may be short-lived, however. Higher tariffs discourage imports and slow shipping volumes over time.

Once tariffs are implemented, importing goods to the US will increase costs. Many retailers will be forced to either absorb costs or pass them on to consumers. This could cause an increase in inflation and affect consumer purchasing behaviors in 2025.

Stay tuned for a future deep dive on universal tariff proposals and their supply chain impacts.

Why Some Companies Choose to Stockpile Inventories

In the short-term, many US businesses are returning to strategies leveraged during Trump’s first term. Brands like Stanley Black & Decker plan to stockpile inventories with imported goods before tariffs are enacted. Chinese exports surged in October, rising nearly 13% year-over-year, and this surge may have been driven partially by frontloading activities ahead of the US election. Organizations will likely expand inventories further in December.

Increasing inventories ahead of Q1 2025 has its risks:

- Some industries, like apparel and footwear, may import items that could age out of season, key trends, or fashions next year.

- Accelerating production may not be an option for all organizations across impacted industries.

- Many supply chain leaders must balance import timing between potential US port strikes and the Lunar New Year starting on January 29.

- Some organizations recall lessons learned after the COVID-19 pandemic, when many struggled to reduce inflated inventories and high supply chain costs amid sluggish sales.

Long-term, supply chain leaders will have to consider other tariff strategies—from absorbing costs to diversifying manufacturing.

Radial will dive deeper into other supply chain strategies beyond stockpiling inventories—such as avoiding price increases and diversifying sourcing—in the future.

How Radial Can Help: Build Inventories with On-Demand Warehouse Capacity

There’s good news: Retailers don’t have to navigate tariff uncertainty alone.

When preparing to stockpile key inventory, supply chain leaders can work with 3PL partners like Radial to manage uncertainty and mitigate risks. They can reduce uncertainty and create time to plan long-term tariff strategies. Radial offers an on-demand solution designed to give retailers the warehouse capacity needed to store surplus inventories ahead of tariff changes.

Retailers leverage Radial’s strategically located facilities across the US to access inventory quickly. Our solution includes on-demand storage options, fast onboarding, critical inventory visibility, and flexible pricing. All with a logistics partner leveraging 30+ years of experience and a leadership team dedicated to helping clients navigate new logistics challenges.

For current Radial clients, we can work with your supply chain leaders to securely store additional inventories in current facilities. That means seamless access through the trusted partnership we already share.

About the Author

Matt Barr | VP, Marketing

Matt Barr guides Radial’s marketing strategies and product innovations to align with our organizational vision. A seasoned professional, Matt has over 15+ years of deep immersion in the logistics sector. Throughout his career, he has donned various hats, giving him a comprehensive understanding of the industry and the brands we serve.

Learn how Radial can help you with eCommerce fulfillment.