High Rate of Returns Fraud Continues to Vex Retailers in 2024

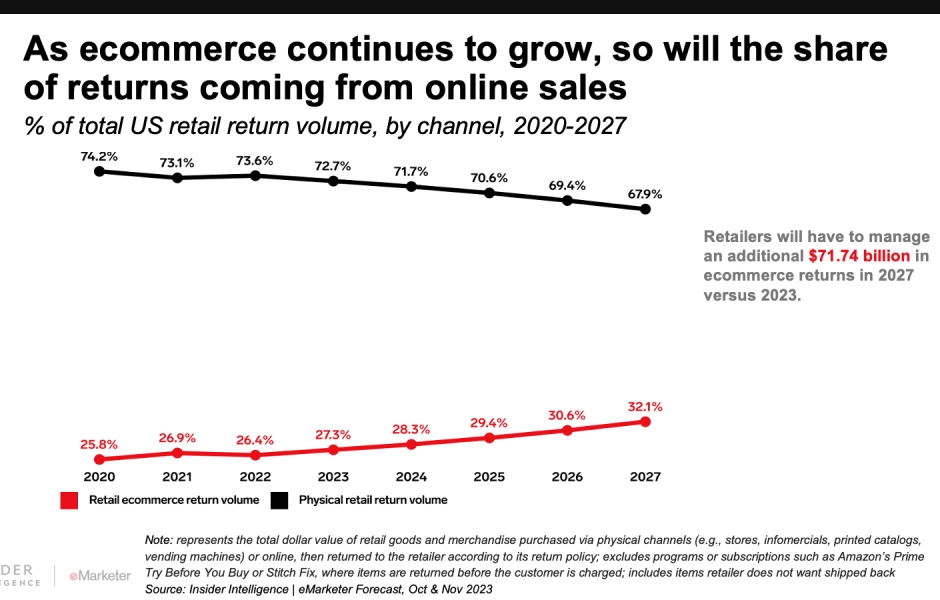

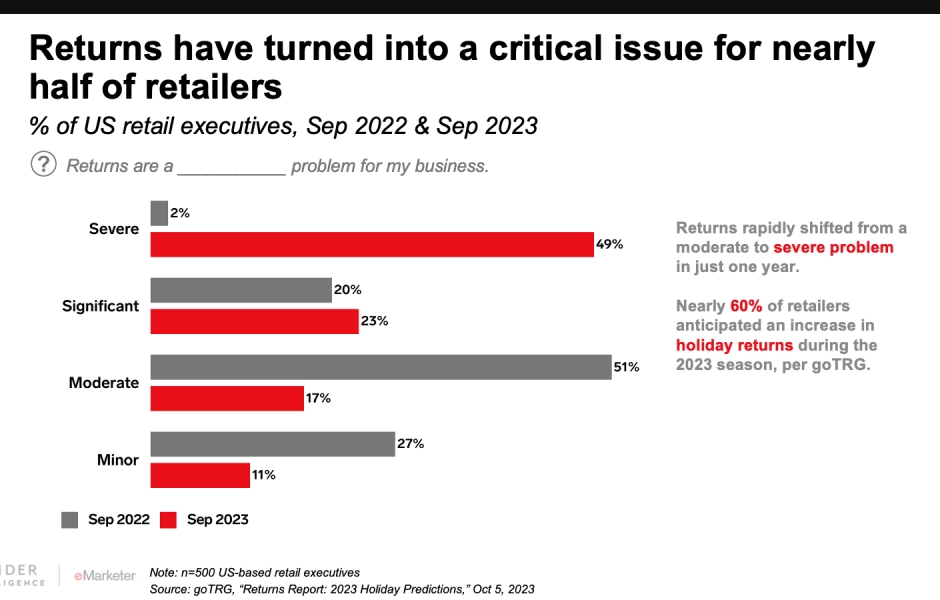

eCommerce returns are poised to grow over the next few years – and so is returns fraud. Insider Intelligence predicts that by 2027, online retailers will manage $72 billion more in returns than last year. Returns – or reverse logistics – are expensive. They are also a significant fraud challenge. In one year, from 2022 to 2023, returns shifted from being a moderate (17%) problem to a severe one (49%) – during which retailers pushed back by instituting return fees.

Charging for returns helped decrease return rates, but it also cost many retailers business. We anticipate that retailers will continue to roll back their more stringent return policies to retain customers. As retailers strategize to contain and minimize return costs, they face a menacing fraud rate.

Returns Fraud Shot Up in 2023

Last year, 54% of retail executives reported that minimizing fraudulent returns was their greatest challenge, second only to managing the high costs of reverse logistics (67%). Return fraud increased from 10.4% in 2022 to 13.7% in 2023.

The total value of fraudulent returns hit $102 billion last year, up 20% from $85 billion in 2022.

Insider Intelligence reports that in 2023, used merchandise (48.8%) and stolen goods (44.2%) were the primary fraud methods, followed by fraudulent payment (37.2%), employee return fraud (27.9%), with a sharp increase in counterfeit receipts (25.6% up from 11.4% in 2022).

We recently reported on how Generative AI is introducing new retail fraud methods in our Top 2024 eCommerce Fraud Hot List, which is based on the leading threats we mitigated for our clients last year.

The escalating rate of fraud, coupled with the mixed results of more robust return policies, has retailers wrestling with how to manage returns fraud more effectively.

Fighting Fraud Requires a Partner Approach

The fraud prevention ecosystem is vast and complex. The threat landscape changes continually. Fraud prevention technology evolves rapidly with AI and machine learning advancements. Vendor rates change or they get acquired and those contracts must be renegotiated. It’s difficult to find, train, and retain highly skilled, experienced fraud prevention talent. Managing an in-house fraud prevention team is costly and comes with the perpetual risk of never truly being on top of the game.

Growing eCommerce companies reach a tipping point where they must hire (or expand) an internal team of fraud prevention specialists or outsource fraud prevention to a proven industry expert.

At Radial Payment Solutions, we provide managed payments, fraud prevention, and chargeback management for eCommerce retailers. We see retailers leveraging a variety of fraud prevention tools and vendors, but one thing most retailers have in common when they come to us is the feeling that they do not have the expertise or bandwidth to manage fraud prevention anymore.

5 Things to Look for in Fraud Managed Services

If you’re considering outsourcing to fraud managed services, here are some things to look for:

- They value their people as much as their technology. While it’s true that technology plays a critical role in fraud prevention, we still need people overseeing it and handling manual reviews. People need to be working closely with technology to provide the best decision making. Fraud prevention is as much about approving legitimate customers as stopping bad actors. The customer experience must remain a top priority while keeping everyone secure.

- They live and breathe eCommerce. Many fraud prevention services handle multiple industries. Pay attention to the percentage of eCommerce clientele they work with and inquire about their longevity in that field. The more specialized in eCommerce the firm is, the more precise service you will get.

- They are not a one-size-fits-all shop. Every online retailer is unique, and while there are common best practices, the services you require will be individual to your business. Look for tailored solutions and for their sales team to take the time to truly get to know how your business works, your goals, your growth plan, and your pain points.

- They value and seek communication. Managed services sounds like a set-and-forget scenario, but a managed team should work very closely with your teams. Communication is important in fraud prevention. We need to know when you are expecting upticks in traffic, when promotions are happening, etc. Look for a firm that takes a partner approach where they demonstrate open, frequent communication.

- They carry the risk. Fraud prevention does not have a 100% success rate and anyone that tells you otherwise is misleading. A fraud management firm should offload the risk of failure from you. Look for fraud indemnification policies.

Work with an eCommerce Fraud Expert

Radial Fraud Zero offers the experience, expertise, advanced AI technology, and the still very necessary human element to fight and prevent fraud. For 25 years, we have specialized in eCommerce businesses. Radial offers a 0% indemnification policy – added assurance that any chargeback fraud that happens under our watch won’t cost you a thing. We also have an industry-leading 99+% fraud approval rate so that you get maximum conversions.

Talk with us.