Discover Top Platform and Channel Trends for Modern Brands

Radial recently launched a new survey of 200 retail decision-makers. Our goal: to learn more about key challenges modern brands experience, and to understand how they plan to grow. And we learned that growing and scaling is hard to do.

- 47% of all respondents cited the ability to manage growth and scale with their existing fulfillment strategy as a significant challenge. And 54% of small businesses (where revenue equals $35M to $50M) cite this as their primary challenge.

- 44% noted their limited ability to add new channels and capabilities as a primary challenge.

- 40% face technology issues, where a lackluster fulfillment tech stack stymies them from executing their growth strategy.

But that’s not stopping modern brands. They continue to optimize their platform and channel mix to drive scalable long-term growth. Let’s dive into the key platform and channel trends uncovered in Radial’s research.

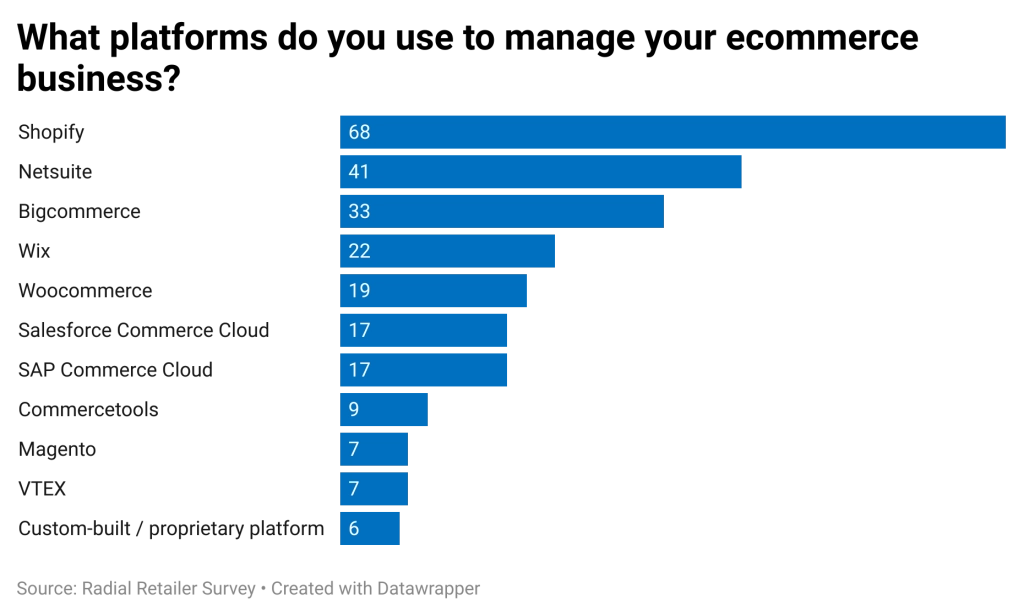

When It Comes to eCommerce Platforms, Brands of All Sizes Choose Shopify, NetSuite, and Bigcommerce

As brands grow, they seek eCommerce platforms to optimize operations, connect them with relevant channels, and improve their customers’ experiences. And 68% of surveyed brands choose Shopify to manage their eCommerce business. While Shopify is the clear front-runner across brands of all sizes, it is selected by 74% of small brands ($35M-$50M). Brands also choose NetSuite (41%) which includes both an ERP and CRM, and 51% of large brands ($150M-$200M) prefer it. One third of brands work with Bigcommerce’s platform, which is less app dependent. Larger brands choose NetSuite and Bigcommerce because their needs change as they scale. As another example, while Salesforce Commerce Cloud or SAP Commerce Cloud are not in the top five platforms among surveyed retailers, they are more often selected by large businesses requiring different functionality from their eCommerce platforms.

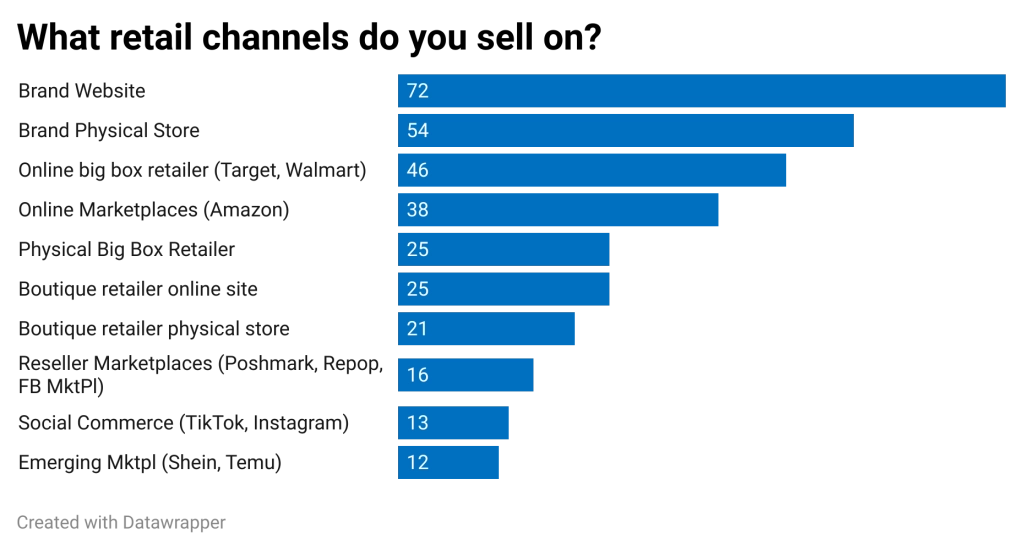

Brand Websites Serve as the Initial Sales Channel, but Brands Seek to Expand into DTC and Marketplaces

Brands start by selling through their own websites, with 72% of respondents indicating their website serves as their primary channel. This breaks down interestingly by industry:

- 89% of home furnishing brands sell primarily via their own websites.

- 81% of apparel companies sell primarily via their own websites.

- 69% of sporting goods brands sell primarily via their own websites.

These category retailers establish their brand identity and promise via an owned customer experience before venturing on to new channels and selling models. Brands do seek to add new channels to expand customer bases, improve cost savings, and expand fulfillment capacity, however. This most often means working with online big box retailers or marketplaces first.

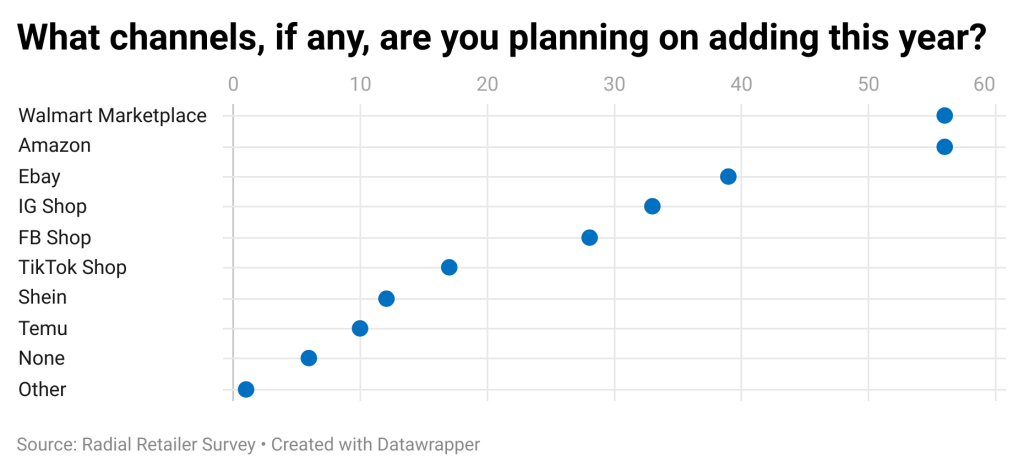

Walmart and Amazon Marketplaces Tie for Brands—But There’s a Catch

Walmart and Amazon tied at 56% for the new channel brands plan to add. This makes sense: Large online marketplaces provide opportunities for modern brands to reach large audiences, and we saw a trend of brands moving toward marketplaces as they grew in revenue size.

But there’s a catch: Walmart and Amazon are also marketplaces brands considered shifting away from—at 49% and 47% respectively. While brands can grow by moving to where customers shop, many retailers are managing a balancing act. They discover new customers in large, well-established marketplaces, but they simultaneously deal with the stringent requirements and high fees often associated with these marketplaces.

We noted that smaller brands are beginning to flock to Walmart’s marketplace. Walmart leverages a rigorous onboarding process, but there is currently less competition in the marketplace than Amazon.

Brands Deprioritize Emerging Channels in 2025

Brands are interested in newer, emerging channels—like TikTok Shop, Temu, and Shein. They are not prioritizing them as highly in 2025 versus more established channels, however. Small brands (with revenues between $35M-$50M) are specifically deprioritizing emerging channels, with just 14% selling on TikTok and 4% selling on Shein and Temu. They show similar levels of interest in adding these channels in the future. These brands instead focus on large channels like Amazon and Walmart, where they have access to more customers.

Larger brands (with revenues between $100M-$200M) take more interest in emerging channels. More than 20% show interest in TikTok and 14% in Temu. Many of these larger brands already have a presence in more established marketplaces, and they are likely looking for new ways to grow.

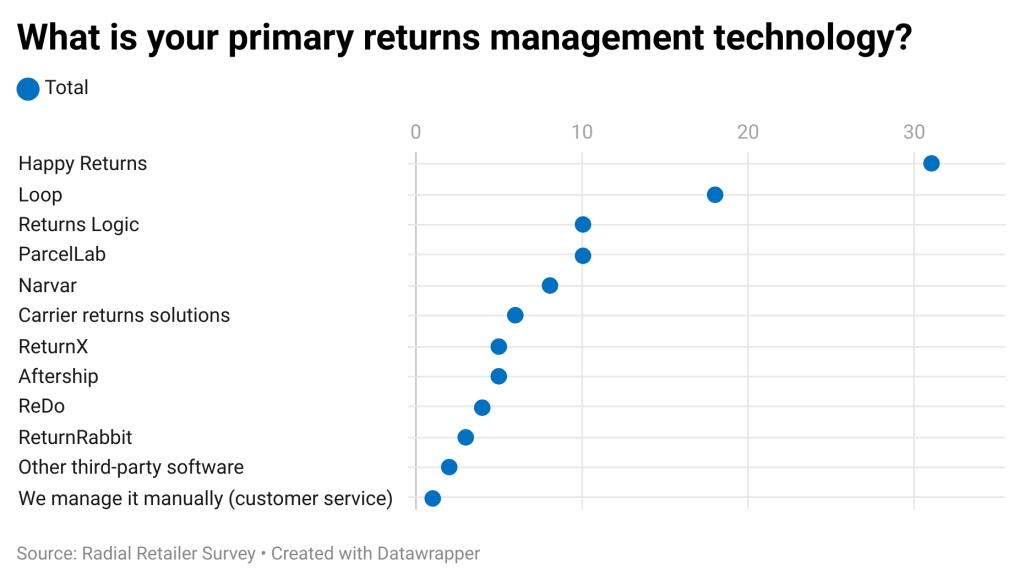

Nearly a Third of Brands Use Happy Returns for Returns Management

Shoppers expect a seamless returns process—from refund through to returns drop-off or shipping. If the returns process creates friction for customers, they will notice and respond. Per Radial’s research, refund processing was the top consumer complaint. Packing items for return shipping was also a common issue, particularly for online apparel orders. Eighteen percent of consumers experienced issues with return packaging or labels and 16% struggled to find return instructions.

Modern brands seek to optimize the returns management process and meet customer expectations by working with a third-party partner. In fact, nearly one third of brands use Happy Returns to support their returns management processes. A further 18% work with Loop, with 26% of small brands ($35M-$50M) choosing it. Only 1% of surveyed brands manage their returns manually.

Omnichannel Fulfillment Means Long-Term Success

Modern brands recognize they cannot rely on individual channels or marketplaces to drive long-term growth. They seek to develop true omnichannel fulfillment and better position themselves to scale and grow.

Radial has the solution: Radial Fast Track. Radial Fast Track provides scalable, cost-effective fulfillment for modern brands, without upfront costs or long-term contracts.

Radial Fast Track can help solve a variety of challenges:

- Expand your brand, grow, and scale: Connect with hundreds of DTC and B2B channel partners quickly and distribute seamlessly.

- Transition from in-house fulfillment to outsourced fulfillment: Onboard fast, with the ability to integrate in as little as a week—no resources required. We streamline fulfillment so that brands can focus on what they do best, knowing their customers get the experience they deserve.

- Navigate transportation and returns challenges easily: Get faster, cost-effective shipping no matter the size of the organization. Simplify delivery with Radial’s last mile solutions. We work with carriers to find the best balance of speed and cost—and we handle returns for you.

Get started with fast, scalable, cost-effective fulfillment.