Tech takes on e-commerce’s $218 billion returns problem

The fashion e-commerce industry faces a $218 billion challenge in product returns, with online clothing return rates averaging 30%. Reverse logistics, the process of managing returns, involves customer initiation, shipping, inspection, and product disposition. Each stage presents challenges in customer satisfaction, inventory management, and sustainability. To address these issues, some tech companies are developing very interesting solutions.

Fashion e-commerce faces a $218 billion crisis: returns. This issue threatens retailers’ profits and sustainability efforts. This isn’t just a matter of lost sales; it’s a complex issue that impacts customer satisfaction, operational efficiency, and environmental sustainability. The reasons behind these high return rates are varied and interconnected. Poor fit and sizing issues top the list, accounting for 70% of returns in fashion retail. The lack of standardization across brands makes it challenging for customers to find the right size, especially when shopping online.

The scale of the problem

The numbers are stark:

- 75% of all returns in 2023 were clothing and accessories.

- Online clothing purchases have a 30% average return rate, with some reports as high as 50%.

- 80% of people who’ve returned an online purchase have returned

But it’s not just about fit. Approximately 13% of returns occur due to customers receiving faulty or damaged goods, highlighting the difficulties in evaluating product quality online. Another 16% of returns happen because items don’t match their online descriptions or images, pointing to a gap between customer expectations and reality. Add to this the phenomena of consumer indecision and buyer’s remorse, and you have a perfect storm of return-driving factors.

Why so many returns?

- Misleading Images: 16% of returns occur because items don’t match their online photos.

- Poor Fit: 70% of returns are due to sizing or style issues.

- Buyer’s Remorse: Many customers simply change their minds.

Customer loyalty vs return rates

Interestingly, the very policies designed to attract customers may be exacerbating the problem. Many retailers offer lenient return policies to maintain customer loyalty, but this approach often encourages higher return rates. It’s a delicate balance between customer satisfaction and sustainable business practices.

Environmental footprint

The impact of these high return rates extends far beyond the balance sheet. There’s a significant environmental cost associated with the transportation, processing, and potential disposal of returned items. The fashion industry, already under scrutiny for its environmental footprint, faces increased pressure to address the sustainability implications of its return practices.

Tech solutions

In response to these challenges, the tech industry has stepped up, offering a range of innovative solutions. Companies like AfterShip and Loop Returns are revolutionizing the returns management process, providing platforms that allow retailers to offer flexible exchange policies.

Fit issue

Addressing the fit issue head-on, companies such as 3DLOOK and Fit3D are leveraging body scanning technology to provide accurate sizing recommendations. By allowing customers to input their measurements or scan their bodies, these technologies aim to significantly reduce returns caused by sizing discrepancies.

Personalization

Personalization is another key strategy in the fight against returns. Stitch Fix, for example, uses data analytics and customer feedback to recommend clothing that fits the customer’s style and size preferences. This approach not only improves the accuracy of fit and style recommendations but also creates a more engaging shopping experience.

AR / VR

The rise of augmented reality (AR) and virtual reality (VR) technologies is also making waves in the fashion e-commerce space. Companies like Sephora and Nike are using AR to allow customers to virtually try on makeup or shoes before making a purchase. These technologies help bridge the gap between online and in-store shopping experiences, potentially reducing returns due to unmet expectations.

These innovations aim to reduce returns by improving fit, personalizing recommendations, and streamlining the return process, but two companies, however, are taking particularly innovative approaches:

Most interesting solutions?

Among the many interesting solutions, two stick out at least in the European landscape: PlatformE, with Headquarters in Porto, Portugal, and Uturn, based in Tel Aviv, Israel. The first one works on preventing the generation of returns, the second is great to mitigate their impact.

PlatformE: predicting demand

PlatformE proposes a “sell-first-produce-later” model. At its core, PlatformE’s approach inverts the conventional production cycle. Instead of manufacturing products in bulk and then attempting to sell them, brands using PlatformE’s technology can showcase virtual designs to customers, produce items on-demand, and deliver them within weeks.

“Our platform allows brands to align production with actual demand,” explains PlatformE’s CEO, Gonçalo Cruz. “This significantly reduces the risk of overproduction and unsold inventory, which are major contributors to waste in the fashion industry.”

Real time data

The model relies heavily on advanced technology. PlatformE utilizes real-time data analytics to help brands understand customer preferences and trends. This data-driven approach enables more informed decision-making regarding which products to produce and in what quantities.

Digital twins

One of the key features of PlatformE’s system is the creation of “dynamic digital twins” – highly detailed, interactive 3D representations of products. These digital twins allow customers to visualize and even customize items before they’re manufactured. “It’s about giving customers a more engaging and personalized shopping experience,” Cruz notes.

The customization aspect is particularly noteworthy. By offering options to tailor products to individual preferences, PlatformE aims to increase customer satisfaction and reduce return rates – a persistent problem in online fashion retail.

Early adopters of PlatformE’s technology are reporting promising results. Luxury brand Dior, for instance, has used the platform to offer customizable sneakers, allowing customers to choose from lots of possible combinations.

The potential impact of this model extends beyond individual brands. By reducing overproduction and waste, PlatformE’s approach could help address some of the fashion industry’s significant environmental concerns. The World Economic Forum estimates that the fashion industry is responsible for 10% of global carbon emissions and 20% of global wastewater. A shift towards on-demand production could significantly reduce these figures.

Moreover, the model could lead to more resilient supply chains. “By producing closer to demand, brands can be more responsive to market changes and reduce their reliance on long-term forecasting,” explains Sarah Johnson, a retail analyst at McKinsey & Company.

As the fashion industry grapples with issues of sustainability and efficiency, PlatformE’s “sell-first-produce-then” model offers a compelling vision of the future. While it remains to be seen whether this approach will become the new industry standard, it’s clear that PlatformE is pushing the boundaries of what’s possible in fashion e-commerce.

The coming years will likely see further refinement of this model, as more brands experiment with on-demand production and customization. For now, PlatformE stands at the forefront of a potential revolution in how we produce, sell, and consume fashion.

PlatformE in short:

- Brands show virtual designs.

- Customers customize products before they’re made.

- Real-time data informs production decisions.

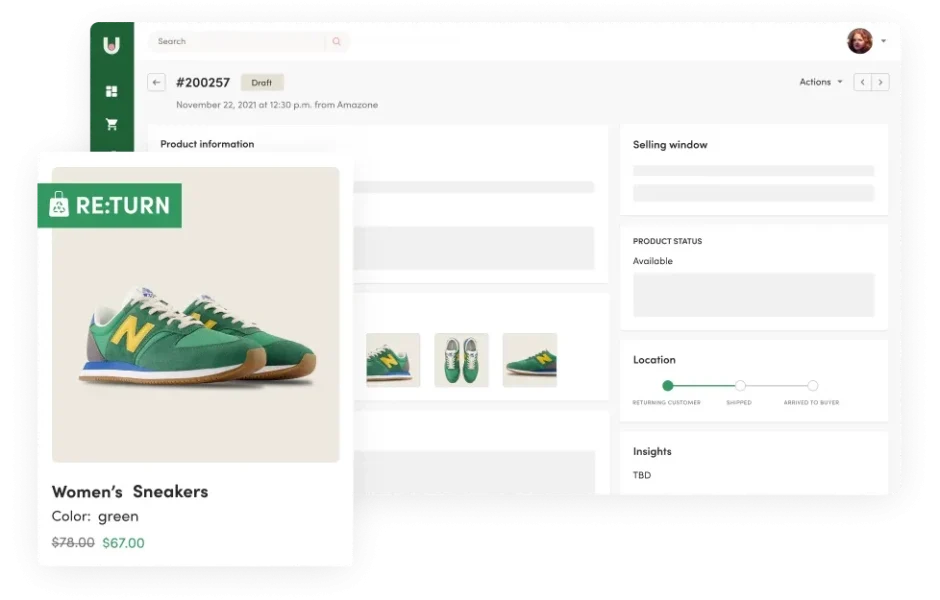

Uturn: P2P returns

Uturn.shop is a platform designed to help businesses manage and sell returned items before they are shipped back to the warehouse. It integrates with existing e-commerce platforms, such as Shopify, to streamline the returns process. Uturn.shop uses an AI quality assurance engine to ensure that only eligible items are resold. Returned items are listed in a virtual warehouse, allowing businesses to manage them, set reselling rules, and gain insights through a dashboard.

The platform offers features like smart widgets that integrate into a business’s website, allowing customers to add returned items to their shopping cart during checkout. This system helps reduce shipping and logistics costs by sending sold return items directly to local customers. Unsold items are returned to the warehouse as usual. Uturn.shop aims to provide a sustainable return experience by reducing waste and carbon footprints, while also increasing revenue by shortening the time from return to resale.

Uturn in short

Uturn creates a customized marketplace for returned items. Via a return app, Uturn seamlessly integrates with the brand’s Shopify platform and returns process, keeping the returns experience untouched. Instead of sending products back to retailers, customers can:

- Sell unwanted items to other customers.

- Exchange items within a peer network.

A step in Uturn’s Shopify process

This system reduces return processing for retailers and keeps more items in circulation. This approach reduces overproduction and ensures brands make what customers actually want.

Returned items that aren’t purchased get shipped right back to the warehouse, just as it does today.

Reverse logistics

The future of fashion e-commerce likely lies in the integration of these innovative models with existing reverse logistics processes. This integration could lead to improved pre-sale validation, streamlined returns processes, and more efficient inspection and processing of returned items. It also opens up opportunities for data-driven insights that can inform future production decisions and help brands adjust their offerings to better meet customer needs.

Challenges

However, implementing these solutions is not without its challenges. The complexity of integrating new technologies with existing systems, the high initial costs of implementation, and the difficulties in managing inventory across different channels are just a few of the hurdles that retailers face. Moreover, meeting customer expectations for fast and seamless returns while also managing production schedules and inventory can be a delicate balancing act.

Potential benefits

Despite these challenges, the potential benefits of addressing the returns problem are immense. By leveraging technological solutions and innovative models, fashion e-commerce brands can work towards reducing return rates, improving customer satisfaction, and promoting more sustainable practices in the industry. As these technologies continue to evolve and become more widely adopted, we may see a significant transformation in how fashion is sold, returned, and consumed online.

But what’s the exact reverse logistics process? Let’s have a closer look:

Inside the e-commerce returns process

The intricate system behind Reverse Logistics, often invisible to the average consumer, involves multiple stages and significant logistical challenges.

The journey of a returned item begins with the customer. When a shopper decides that a product isn’t suitable, they typically initiate the return process through the retailer’s online portal or customer service department. This first step involves requesting a Return Merchandise Authorization (RMA) and obtaining a return shipping label.

Once the return is initiated, the item embarks on its journey back to the retailer. Customers may drop off the package at a designated location or schedule a pickup, depending on the options provided by the retailer. This step in the process highlights the importance of convenient return options in the competitive e-commerce landscape.

The next phase occurs at the retailer’s fulfillment center, where returned items undergo a thorough inspection. Staff check for damages, verify that the original packaging is intact, and ensure that the product hasn’t been used. This inspection is critical for determining whether an item can be restocked and resold, or if it requires alternative processing.

A moment in returns handling within one of the Radial Europe fulfillment centers.

After inspection, the retailer processes the return according to their policy. This may involve issuing a refund to the customer’s original payment method, providing store credit, or facilitating an exchange for a different size or product. The speed and efficiency of this step can significantly impact customer satisfaction and the likelihood of future purchases.

The final stage in the returns process involves deciding the fate of the returned item. Products in pristine condition are typically restocked for resale. Items with minor issues might be refurbished before being put back into inventory. Unfortunately, some returns end up being disposed of, raising important questions about sustainability in the e-commerce sector.

To summarize, the general returns processing workflow includes:

- Customer Initiates Return: Through online portal or customer service.

- Shipping the Return: Customer sends the item back to the retailer.

- Receiving and Inspecting the Product: Thorough checks at the fulfillment center.

- Processing the Refund or Exchange: Based on retailer’s policy.

- Disposition of Returned Product: Restocking, refurbishing, recycling, or disposal.

This complex process represents a significant challenge for e-commerce retailers, particularly in the fashion industry where return rates can be exceptionally high. As online shopping continues to evolve, efficient and customer-friendly returns processing will remain a key differentiator in the competitive e-commerce landscape.

The rising tide of fashion e-commerce returns

The retail industry continues to grapple with the persistent challenge of product returns. In 2023, nearly half of retailers (49%) deemed returns a severe issue, highlighting the urgency of addressing this problem. As we move forward, retailers must focus on key areas to effectively manage peak return periods.