Modern Brands Face an Operational Turning Point

Modern direct-to-consumer (DTC) brands face a turning point. They were celebrated for upending traditional retail models with sleek branding and digital convenience. But after years of explosive growth, once nimble brands now grapple with the realities of scale and the evolving expectations of consumers.

Radial recently completed a survey of 1,000 consumers to learn the new rules for DTC brands, which revealed a shift in how shoppers evaluate and remain loyal to modern DTC brands. As online competition intensifies and consumer expectations soar, DTC brands’ successes hinge less on branding and storytelling and more on scalable operational execution.

DTC Growth and the New Rules of Customer Loyalty

The rise of now well-established DTC brands like Everlane, Warby Parker, Harry’s, and Away, marked a seismic shift in how people shop. These brands launched online and bypassed traditional retailers to connect directly with customers. They offered not only a product, but a story. Over time, many of these brands grew into omnichannel players. Glossier now sits on Sephora shelves, Bombas stocks its socks at Nordstrom. But they still carry the hallmarks of modern DTC: sleek branding, mission-driven messaging, and customer-first design.

That’s important, because consumers expect high quality, unique products. Thirty-two percent of consumers say product quality is the top reason they choose to buy from a DTC brand, and 29% are motivated by access to unique products they can’t find anywhere else. That’s the initial draw and the reason consumers buy from a brand. But today, that’s no longer enough to earn customers’ loyalty. They want more.

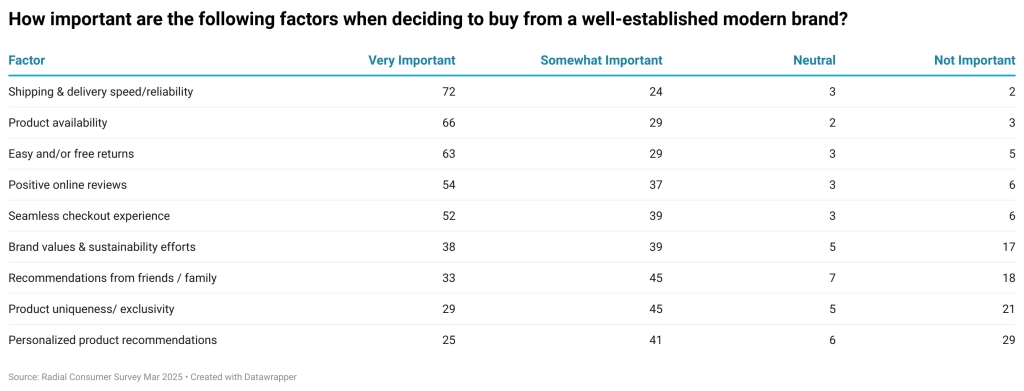

Products aren’t what convert shoppers to customers—it’s operational performance. According to Radial’s survey, 72% of consumers say shipping speed and reliability are the most important factors in deciding whether to buy from a DTC brand. Product availability (66%) and easy/free returns (63%) rank even higher than values like brand identity or personalization. While brand values resonate with 38% of shoppers, and personalized recommendations with 25%, the data shows that it’s the full order experience—from shopping cart to delivery—that drives conversions and long-term loyalty.

For modern DTC retailers, branding drives interest, but great fulfillment builds trust.

The Fulfillment Bottleneck Breaks Brand Trust

At a certain point in their growth journey, modern brands must reassess their fulfillment strategies to determine how best to scale. DTC pioneers disrupted retail, and now they face disruption from within. According to Radial’s survey of retail brands, 70% still rely on in-house fulfillment. In-house fulfillment often works for emerging brands but creates challenges as these brands grow and operations become more complex. It is highly resource intensive, requires capital to scale, and can distract brands from focusing on core competencies like operational strategy and product development. Worse, it also causes modern brands to lose customers.

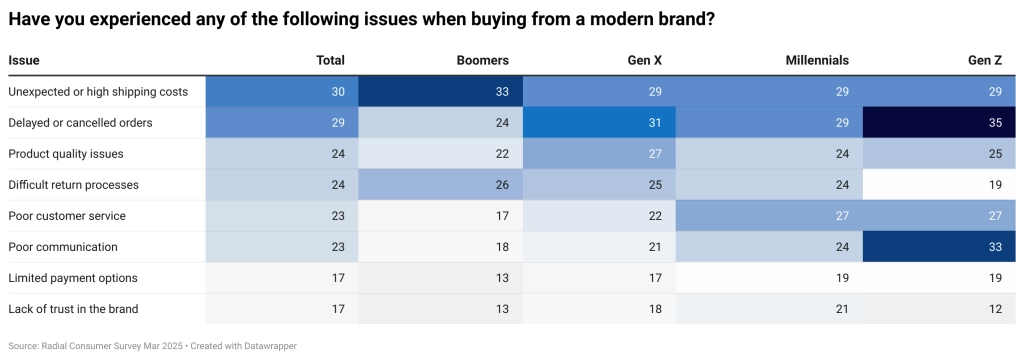

Nearly 40% of consumers stopped buying from a DTC brand they liked because the brand couldn’t keep up with demand. Delayed or canceled orders (29%), unexpected shipping costs (30%), and difficult returns (24%) create a customer experience that contradicts the polished image many of these brands present. It breaks the fulfillment promise shoppers expect when they order.

Younger shoppers are particularly unforgiving. Gen Z (35%) and Millennials (33%) report the highest frustration with delays and lack of communication, reflecting expectations shaped by Amazon-era convenience. Boomers, on the other hand, are more sensitive to price-related friction, with 33% abandoning carts due to high shipping costs.

This creates a challenge across demographics. Shoppers want DTC brands to offer fast, inexpensive, and reliable delivery. When they can’t, customers lose trust and find new brands.

Quality is Key

Shoppers lose faith in brands when the experience no longer matches the brand’s promise. And consumers hold DTC brands to a high standard when it comes to product quality. Sixty-two percent of consumers say that declining product quality will cause them to lose trust in a brand. This mirrors similar trends Radial uncovered in the home furnishings and sporting goods industries.

It’s not solely the product’s quality, but also the fulfillment process’s quality that counts. From reliable shipping to order transparency to easy returns, the data shows that operational consistency, not just a great product, is essential to building brand trust and customer loyalty. For brands that began as online disruptors and have since expanded into retail or marketplaces, the challenge is even greater: maintaining the agility and experience of a digital-first brand while operating at an omnichannel scale.

Scaling Smart: Fulfillment as a Competitive Advantage

The next chapter for DTC brands isn’t about reinvention—it’s about reinforcement. As brands mature, they need logistics infrastructure that matches the pace of their growth. That’s where modern fulfillment strategies come into play.

Radial’s survey findings show that nearly half of decision-makers (47%) struggle to scale fulfillment using their existing operations. They need configurable, cost-effective, and tech-enabled solutions. And these capabilities are especially critical when brands expand across channels while attempting to meet the rigorous demands of consumers.

Whether a brand is DTC-only or expanding into retail and marketplaces, scalable fulfillment must be part of the equation. This isn’t just about fixing inefficiencies. It’s about protecting what makes a brand valuable in the first place. In a world where 62% of shoppers abandon brands over quality or delivery issues, fulfillment is no longer a support function. It’s the brand promise delivered.

Introducing Radial Fast Track

The evolution of DTC requires a new kind of infrastructure—one that matches the changing needs of the brand while providing the reliability of enterprise-grade operations.

Radial has the solution: Radial Fast Track. Radial Fast Track provides scalable, cost-effective fulfillment for modern brands, without upfront costs or long-term contracts.

Radial Fast Track can help DTC brands solve fulfillment bottlenecks and provide fast, reliable, and cost-effective fulfillment to customers:

- Transition from in-house fulfillment to outsourced fulfillment: Onboard fast, with the ability to integrate in as little as a week—minimal resources required. We streamline fulfillment so that brands can focus on what they do best, knowing their customers get the experience they deserve.

- Faster, cost-effective shipping: Simplify delivery with Radial’s last mile solutions. We work with carriers to find the best balance of speed and cost.

- Expand your brand, grow, and scale: Connect with hundreds of DTC and B2B channel partners quickly and distribute seamlessly.

- Ditch returns headaches: Leverage streamlined technology and processes. Make returns easy.

Get started with fast, scalable, cost-effective fulfillment.